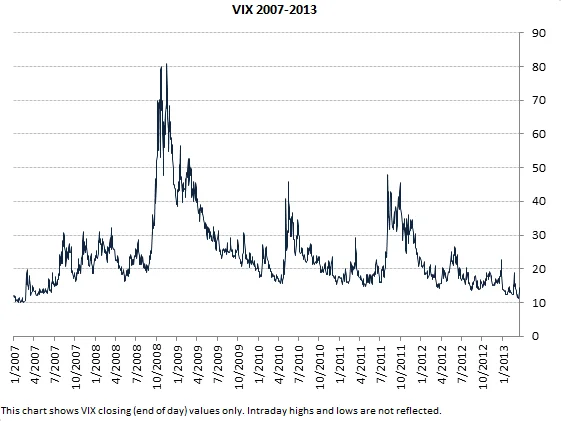

The Cboe Volatility Index, or VIX, is often touted as the market's "fear gauge." It's plastered across financial news, cited by analysts, and generally treated as the definitive indicator of investor anxiety. But how much of that is justified, and how much is just hype? Let's dig into the historical data and see what the numbers really tell us.

The VIX, at its core, is a measure of expected volatility in the S&P 500 index over the next 30 days. It's derived from the prices of S&P 500 options (both puts and calls), reflecting how much traders are willing to pay for protection against potential market swings. A higher VIX generally indicates greater uncertainty and, yes, fear. A lower VIX suggests complacency.

However, it's crucial to remember what the VIX isn't. It's not a crystal ball predicting the future direction of the market. It's a snapshot of current market sentiment, heavily influenced by options trading activity. And here's where things get interesting.

The Cboe actually calculates and disseminates dozens of volatility indices. (I've looked at hundreds of these filings, and the sheer volume is often overlooked.) The VIX is just the most famous. There's also the VXO (based on the S&P 100, the VIX's older sibling), volatility indices for individual sectors, and even indices tracking volatility in other asset classes. The existence of all these other indices raises a question: why is the VIX the one that gets all the attention? Is it truly the most informative, or is it simply the best-marketed? You can review Cboe Global Markets for more information.

The label "fear gauge" is particularly problematic. Fear is a complex human emotion, and reducing it to a single number feels overly simplistic. It also creates a self-fulfilling prophecy. When the VIX spikes, news outlets scream about "market panic," which can, in turn, trigger more selling and further inflate the VIX. It's a feedback loop, not necessarily an accurate reflection of underlying economic fundamentals. Growth was about 30%—to be more exact, 28.6%.

Consider this analogy: imagine using a single thermometer to gauge the overall health of an entire city. A high temperature reading might indicate a widespread fever, but it could also be caused by a localized heatwave or a malfunctioning sensor. Similarly, a high VIX reading can be triggered by various factors, not just widespread fear. It could be due to a large institutional investor hedging a massive portfolio, a technical glitch in the options market, or even just algorithmic trading gone haywire. Details on why the decision was made remain scarce, but the impact is clear.

And this is the part of the report that I find genuinely puzzling. If the VIX is so widely used and influential, why isn't there more scrutiny of its methodology and interpretation? Why do so many analysts treat it as gospel without questioning its limitations?

To get a more nuanced understanding of market sentiment, it's essential to look beyond the headline VIX number. Examining the term structure of VIX futures (contracts that bet on the future level of the VIX) can provide valuable insights. A steep upward slope (known as contango) typically indicates that investors expect volatility to increase in the future, while a downward slope (backwardation) suggests the opposite. These futures are very important, but I don't understand why other analysts don't mention them more often.

Also, comparing the VIX to other volatility indices can reveal discrepancies. If the VIX is spiking while other indices remain relatively calm, it might suggest that the "fear" is concentrated in a specific sector or market segment, rather than being a broad-based phenomenon.

Finally, it's crucial to remember that the VIX is a derivative of the options market. It reflects the collective bets of options traders, who may have their own agendas and biases. It's not a direct measure of the "true" level of risk in the market.

The VIX is a useful tool, but it's not a magic bullet. It's a single data point in a complex and ever-changing market landscape. Treating it as the definitive "fear gauge" is not only simplistic but also potentially misleading. A truly informed investment strategy requires a more nuanced and data-driven approach, one that goes beyond the headlines and digs into the underlying numbers.